Offers Insightful Data-Driven Visuals for Compliance, Fraud and Dispute Trends

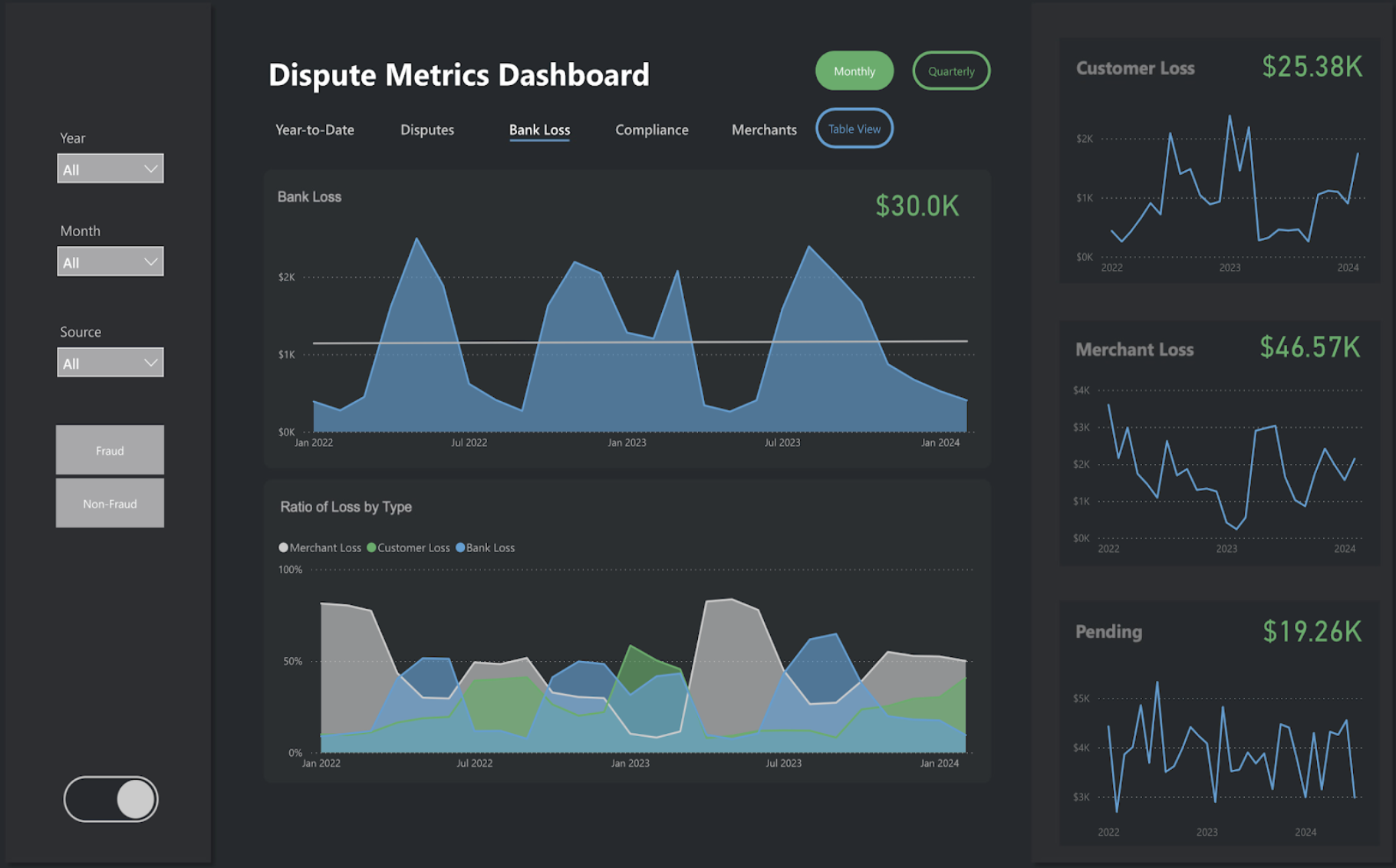

HOUSTON, Oct. 23, 2024 /PRNewswire/ -- FINBOA Inc., a leading provider of intelligent process automation for regulatory compliance in financial institutions, announces FINBOA BI Disputes, a pioneering Business Intelligence (BI) solution designed to help banks and credit unions gain actionable insights into fraud, compliance, and dispute trends. Built as a powerful companion to FINBOA Payment Disputes, this solution offers financial institutions the tools they need to make data-driven decisions and mitigate risks associated with fraud and compliance failure.

"Using FINBOA BI Disputes, our financial institution customers will be empowered to make data-driven decisions, mitigate risks, and streamline processes. The BI Disputes solution provides easy access to critical dispute data in visual form," said Raj Singal, CEO and Founder of FINBOA. "We are thrilled to offer this business intelligence companion to FINBOA Payment Disputes enabling banks and credit unions to visualize dispute trends to assist in fraud, compliance and operations management decisions."

FINBOA BI Disputes features empower finance management, operational management, fraud risk and compliance teams. Key capabilities include: comprehensive reports, dynamic filters, export options, compliance monitoring and fraud trend analysis. These innovative features provide easy access to critical information eliminating the time-consuming hassle of manually pulling together data from multiple sources. Customizable table views and export data are quickly accessed for further data analysis.

To learn more, register for the upcoming webinar: Unlock the Power of Business Intelligence (BI) to Improve Dispute Management to be held on October 30 from 12:30-1:00 p.m. CT.

About FINBOA

FINBOA provides intelligent process automation software to banks and credit unions to simplify dispute processing and improve regulatory compliance by eliminating manual systems. Solutions include FINBOA Payment Disputes along with companion products, FINBOA BI Disputes and AutoDecision. FINBOA delivers transformative software proven to enable institutional growth by reducing operational costs and risk.

In 2024, FINBOA received industry accolades including the PayTech USA Award: Tech of the Future, Finovate Award finalist, CU Times Luminary Award for Product Innovation, Jack Henry Associates' Cobalt Integrator's Award and selection for the ICBA ThinkTech Accelerator's program; as well as being named to the INC 5000 list of fastest growing U.S. businesses.

Headquartered in Houston, FINBOA is trusted to help over 250 financial institutions nationwide achieve targeted business outcomes and peace of mind.

Learn more at www.finboa.com or follow us on LinkedIn, Facebook and X Twitter.