In today’s complex financial environment, payment disputes present significant risks and challenges for financial institutions, particularly under regulations like Regulation E (covering electronic funds transfers) and Regulation Z (governing credit card transactions). Senior management must not only ensure compliance but also optimize dispute handling to maintain customer trust and minimize financial losses. Here’s why business intelligence (BI) data and dashboards are essential tools for this purpose:

1. Ensuring Compliance with Precision and Ease

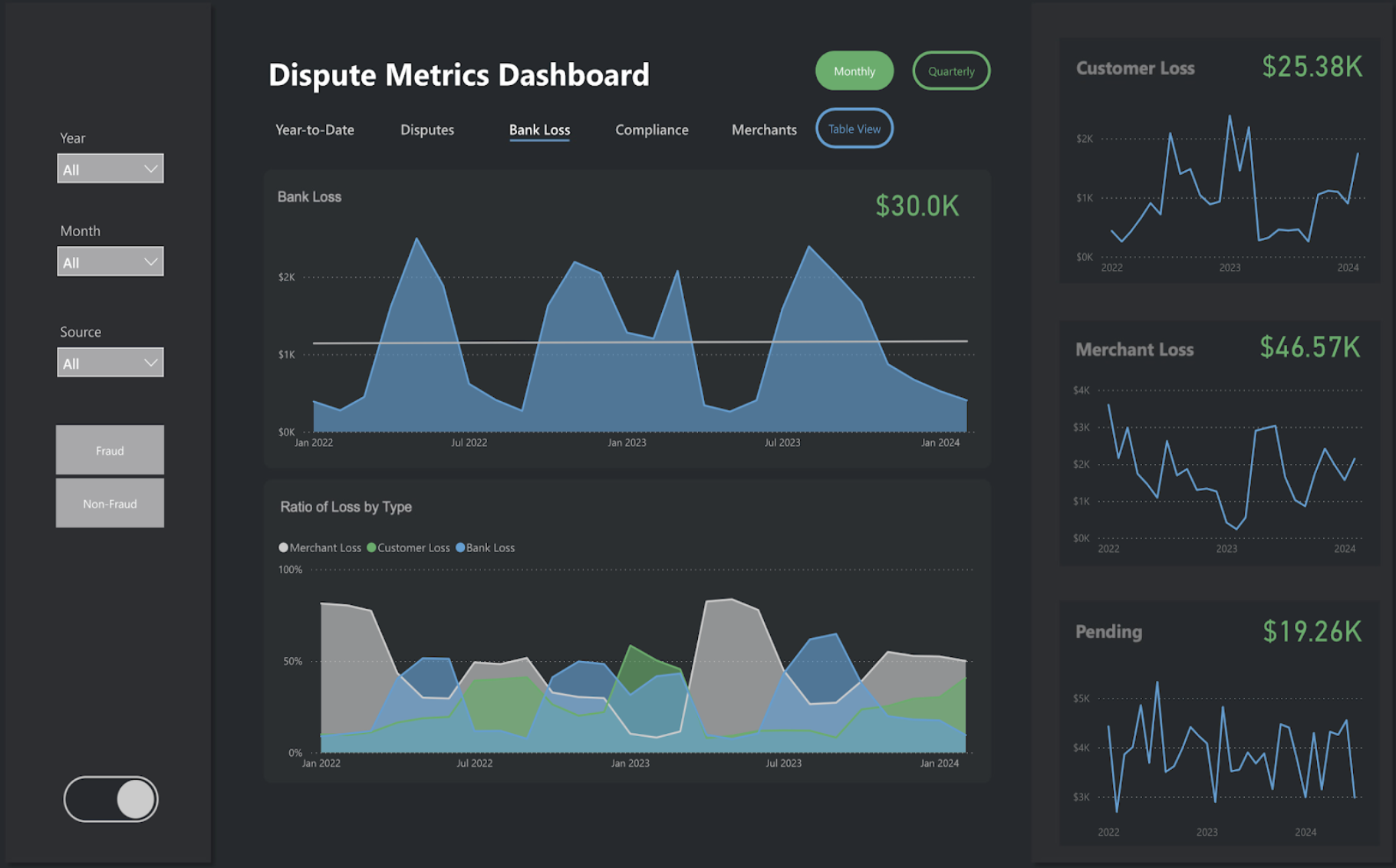

Regulations like Reg E and Reg Z impose strict timelines and procedural requirements for handling disputes. BI dashboards provide real-time insights into compliance metrics, such as provisional credits and resolution deadlines, allowing senior operations leaders to monitor compliance status effortlessly. By visualizing key compliance indicators, dashboards help streamline the audit process and reduce the risk of regulatory breaches, which could lead to costly fines and reputational damage.

2. Proactive Fraud Detection and Management

Disputes often arise from fraudulent transactions. With BI data, banks can analyze patterns and trends across disputed transactions, identifying potential fraud hotspots and problematic merchants. Dashboards make it easy to filter disputes by type—fraud versus non-fraud—allowing senior leaders to quickly assess where to allocate resources and address vulnerabilities. This proactive approach not only helps in fraud mitigation but also builds a stronger defense against emerging threats.

3. Enhancing Decision-Making with Real-Time Insights

Senior executives require a holistic view of payment dispute trends to make informed strategic decisions. BI dashboards aggregate data across various metrics, such as the number of disputes, loss ratios, and resolution times, offering a comprehensive snapshot of the dispute landscape. These insights enable CEOs, COOs, and CFOs to assess financial impacts, adjust risk management strategies, and ultimately drive more efficient operations.

4. Optimizing Operational Efficiency and Reducing Costs

Business intelligence tools help operations teams reduce manual processes by offering automated, data-driven reporting. Dashboards can reveal inefficiencies, such as longer-than-average resolution times or high dispute volumes from certain channels. By pinpointing these bottlenecks, institutions can streamline workflows, allocate resources more effectively, and improve overall dispute handling, which translates to cost savings and better customer service.

5. Supporting Strategic Planning and Growth

BI dashboards not only support day-to-day operational improvements but also play a key role in long-term planning. By continuously tracking dispute metrics, financial institutions can assess changes in customer behavior, fraud patterns, and compliance challenges over time. This historical data can inform strategic decisions, helping leadership anticipate future trends, adjust product offerings, and improve risk mitigation strategies.

Conclusion

For senior banking management, leveraging business intelligence in payment disputes is no longer optional—it’s essential. BI dashboards provide a powerful framework to drive compliance, manage fraud, optimize operations, and support strategic growth. By integrating these tools into dispute management processes, financial institutions can strengthen their regulatory posture and enhance their ability to respond to evolving industry challenges. Learn more about FINBOA's BI Disputes solution.